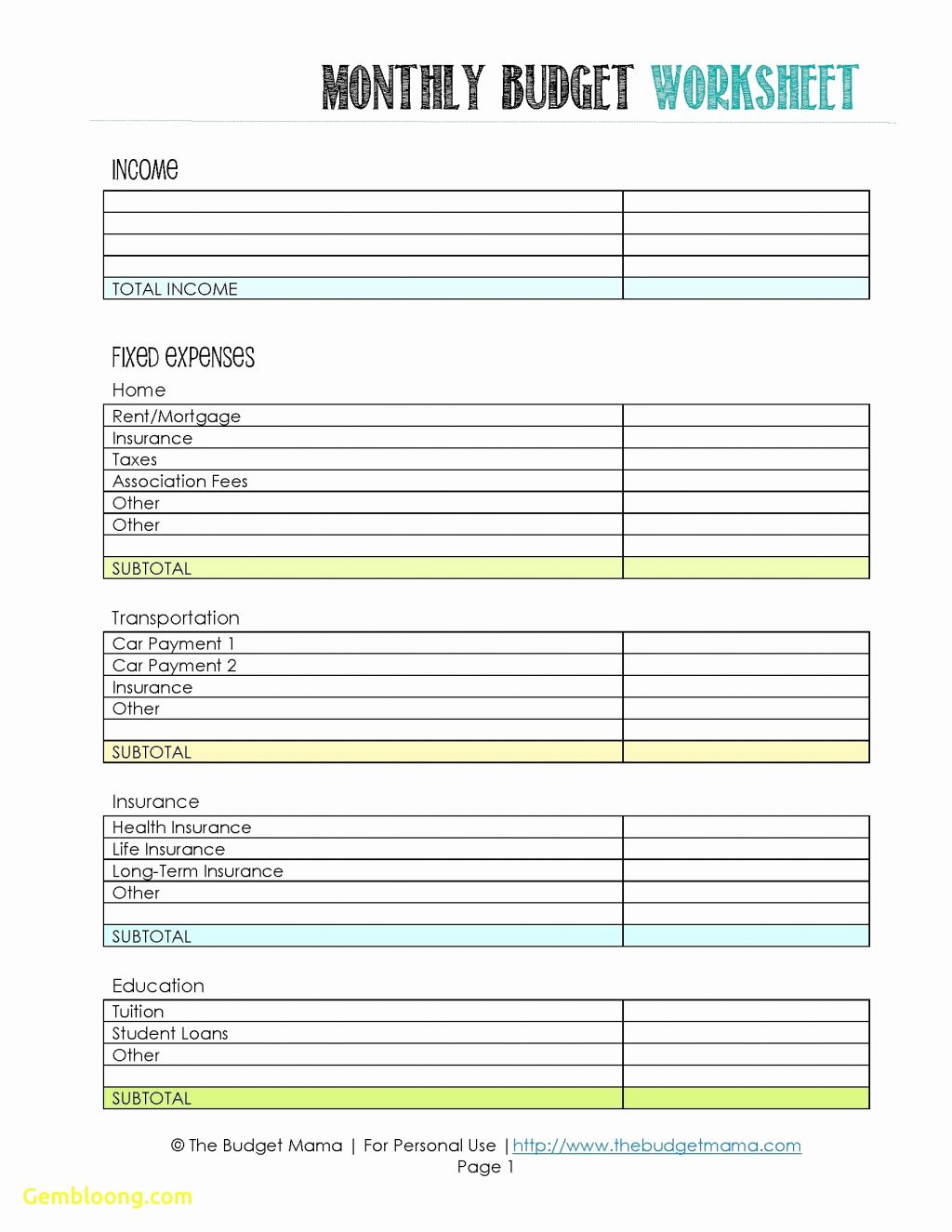

That’s why you shouldn’t spend more than 25% of your take-home pay on housing. You have to give your budget room to grow. You can get one through one of his smart lenders. So think taxes, insurances, HOA fees, and mortgage insurance.Īnd if you’re buying a home, Dave recommends a 15-year, fixed-rate, conventional mortgage. This includes your rent or mortgage plus any other monthly fees associated with it. Housing – 25%ĭave Ramsey’s budget percentages encourage you to allocate no more than 25% of your take-home pay to housing. So let’s breakdown D ave Ramsey’s budget categories so you’ll have a better understanding of how this works. Now to help you get started, we’re giving you a free budgeting worksheet below: Once you start budgeting this way, you’ll surprise yourself with how much money you start saving. You see how every dollar has a purpose? Including things like fun money and savings? This is a powerful trick for preventing yourself from wasting money. You see, that $250 has to be assigned to a category. That’s great – but you aren’t finished budgeting yet. Let’s say you budget for all your expenses and still have $250 leftover. This means every single dollar has to be assigned to a category. It’s a type of budgeting that encourages you to account for every dollar you earn. It’s called the zero-based budget.Īccording to research, when you use a zero-based budget you’ll pay off 19% more debt and save 18% more money. Let’s talk about the method Dave Ramsey recommends.

Now you’re probably wondering, “What budgeting method do I pick? 50/30/20 method? Half payment method? Reverse method?” How to Make a Budget Using the Dave Ramsey Plan So as an ode to our favorite financial expert, let’s show you how to budget like Dave Ramsey. He’s got over 14 million listeners on The Dave Ramsey Show – making him one of the most popular radio hosts in the country.Īnd he’s been changing people’s financial lives for more than 25 years.

He’s had over 5 million people participate in his Financial Peace University program. Dave Ramsey knows about personal finance.Īnd regardless of what some critics might say about Dave, he’s probably helped more people become debt-free than anyone else on the planet.

0 kommentar(er)

0 kommentar(er)